Gold, it seems, is not the only valuable mineral in our world. Of course silver has taken a run in price every time gold values spike. This is the market at work.

You might be surprised to learn that other minerals are garnering attention. Minerals such as those called “rare earth minerals”. It’s not what the name suggests though. Rare earth minerals are not really rare in reality. The costs associated with extraction of rare earth minerals is high and it is problematic. The process of recovery carries a very significant environmental cost.

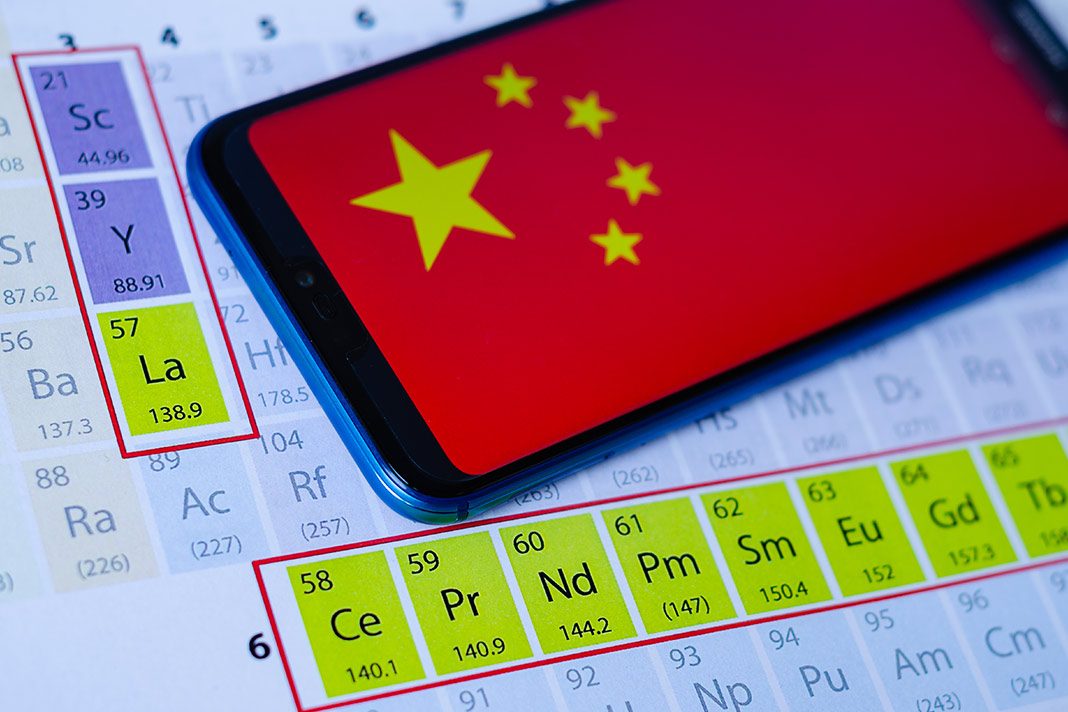

Rare earth minerals comprise roughly seventeen specific minerals (What are Rare Earth Minerals). These minerals are used in a wide array of products from medicine, defense, and computer equipment. Our modern world has become increasingly more dependent upon them.

The vast bulk of production of the mining of rare earth minerals comes out of China, namely 90%. Cheap labor and environmental tolerance has come into play here. It should be noted that rare earth minerals recovery is a byproduct of Chinese steal manufacturing. Essentially the United States was the worlds leader in rare earth mining, but stopped producing in 2017. This was when the mining firm went into receivership.

With the highly talked about trade war between the United States and China waging it has become a hot spot. China no doubt would weigh the impact to it’s economy by weaponizing the export of it’s commodity of rare earth minerals. Weaponizing rare earth minerals by China would not be the first attempt to interfere with these commodities market price. Prices did rise when China restricted sales to Japan earlier, but Japan made adjustments and skirted through. Prices stabilized and life in the marketplace went on.

That was then, but now the United States Department of Defense is shifting it’s focus to counter this current area by ramping up supply alternatives. Discussions with Australia have began sometime ago. It’s unclear if mining will occur or what will transpire.

Value hunters have been savvy to this issue in the Japan-China fracas and before the current trade disputes threatened the supply chain. Interest in other mining corporations that offer to enter this supply chain are being looked at now.

Recognizing the potential shortage of the minerals in the supply chain some countries are taking their own positive action. In the United Kingdom a recycling program commenced to combat this issue. Recycling had been previously a minimal alternative with little attention being paid to this until now.

Thieves emerge if the prizes get larger enough. It would now appear lucrative enough to appear to be across that threshold in Africa https://www.thecitizen.co.tz/news/1840340-5257358-9bd2hy/index.html). This is problem in the United Kingdom as well (gangs stripping cars of catalytic converters in broad daylight). People in North America are not immune either as the theft of catalytic converter theft is more common.

As these matters continue to develop, it certainly warrants keeping a closer eye on how the market reacts.